Contents:

Oil and gas majors like BP and Shell have seen their profits surge this year on higher prices for fossil fuels following the pandemic and Russia’s invasion of Ukraine. This has brought a significant benefit to BP, which has experienced various challenges since the Gulf of Mexico oil spill in 2010. While the write-down was a one-off charge, exiting its profitable Rosneft holding has had some longer-term impacts on underlying earnings.

First Solar (FSLR) Q4 2022 Earnings Call Transcript – The Motley Fool

First Solar (FSLR) Q4 2022 Earnings Call Transcript.

Posted: Tue, 28 Feb 2023 08:00:00 GMT [source]

Fermenta bio expected to report revenue growth of 4.6% YoY to INR 941mn, despite of continued traction in the Human VD3 business (80% of overall VD3 sales H1FY22) due to planed shutdown for capacity expansion. However, owing to a high base, the EBITDA margin can contract by 887bps to… It announced a deal with Qantas for 12 Trent XWB-97 engines to power its A350s, along with a service agreement for those engines. In addition, the sale of ITP Aero for £2bn is expected to complete soon with the proceeds earmarked for debt pay-downs. Rolls-Royce also appears to be making strides in its power systems business. The small nuclear reactor project, announced last year following investment from private sources and the government, has the potential to be a huge revenue driver, despite significant upfront costs.

Disclaimer Past performance is not a reliable indicator of future results. It increased the upper range of its forecast overall annual investments to 2030 to $14 billion to $18 billion from $14-$16 billion previously. In a strategy update, BP said it now aims to produce 2 million barrels of oil equivalent per day by 2030, down 25% from 2019 levels, but less ambitious than previous plans to cut output by 40% over the period. For the year, BP’s profit of $27.6 billion exceeded the previous record of $26 billion in 2008.

BP profit soars to record $28 billion, dividend increased

After the US Federal Reserve raised rates by 0.75 percentage points for the second month in a row on Wednesday, the Bank of England is now under pressure to deliver a bumper interest rate hike of its own. Although that puts a half-point rise very much on the table, it’s worth noting that, since the Bank of England was given independence over monetary policy in 1997, it has never raised rates by more than 0.25 points. This speaks to the central bank’s conservative mindset, potentially making it difficult for policymakers to shift their thinking. Rate hikes at each of the last five meetings have lifted the Bank’s base rate to 1.25%. The material is for general information purposes only, and does not take into account your personal circumstances or objectives.

This outperformance has been all the more surprising given HSBC’s exposure to the Chinese economy, which has been badly affected by intermittent lockdowns this year. The jobs report for July is expected to show that 250,000 non-farm jobs were added. However, that headline number is of lesser importance than wage growth at the moment, which is expected to remain steady at around 5%.

Airbnb Q2 results

We believe that most chemical https://1investing.in/ have ramped up their utilization levels, resulting in margin normalization. Overall, our Chemical coverage would post a Revenue/EBITDA/PAT growth of 25.9%/14.2%/14.1% YoY in Q3FY22. We expect the EBITDA margin of our coverage universe to contract by 187bps YoY, owing to elevated input costs, freight and power costs…. Despite the underlying profit growth, BP still saw a final loss for the quarter as the company took a huge one-off write-down from its exited Russian businesses.

BP completes $4.1B acquisition of Archaea – Waste Dive

BP completes $4.1B acquisition of Archaea.

Posted: Wed, 28 Dec 2022 08:00:00 GMT [source]

The company said it will increase its focus on low-carbon bioenergy and also set a target to produce 0.5 million-0.7 million tons a year of low or zero-carbon hydrogen to initially supply its own refineries. As a result of “market access and other benefits arising out of the business combination”, BP also recognized an increase of $854 million in the “goodwill arising on acquisition.” Rolls-Royce shares hit an 18-month low ahead of the Q1 numbers back in May, but have performed much better since then, albeit in a fairly confined range. The various problems with the resumption of civilian air travel have meant that this year’s anticipated revenue rebound has been slow to materialise. Nonetheless long-term flying hours in Q1 were 42% higher than for the same period last year, although that’s quite a low bar. Shares in HSBC are up more than 8% year to date, outperforming its three major peers in the UK banking sector – Barclays, Lloyds and NatWest.

German engineering major Siemens is recording perhaps its best growth ever in India. The oldest multinational corporation in the country has been aggressively bidding for, and winning, contracts across segments, the latest being one for ₹26,000 crore from the Indian Railways. The company also announced plans to repurchase $2.75 billion worth of shares over the next three months after buying $11.7 billion in 2022. It halved its dividend to 5.25 cents in July 2020 for the first time in a decade in the wake of the pandemic.

Annual inflation in the United Kingdom is at 7%, its highest since 1992, part of a broader global trend. Prices are set to keep rising after Britain’s energy regulator approved a 54% increase in gas and electricity bills for millions of households that took effect in April. The company said it would pay a dividend of 5.46 cents per share and buy back another $2.5 billion in shares. Migration to financial savings, wider distribution and sustainable performance are expected to enable growth in the industry.

MORE KEY EVENTS (1-5 AUG):

The company has posted revenue of INR4,711mn with 21.6% YoY growth which was 12.2% above our estimate of INR 4,198mn. Revenue beat was mainly driven by optimum utilization of PA4 and a sharp increase in the MA realization. Despite increased contribution from high margin product , gross margin witnessed 449bps contraction on QoQ basis, and 167 bps decline on YoY basis due to contraction in PAN/OX spread. On the most recent earnings call, AMC’s CEO Adam Arons said he was hopeful that Q4 box office receipts could exceed pre-pandemic levels, adding that AMC is looking to acquire more theatres and move into other industries.

While appearing confident in the outlook, Arons must be aware that the business still carries debts of over $5.5bn. It might perhaps be prudent to stabilise the balance sheet before expanding or diversifying. Revenue from admissions accounted for $443.8m of total revenue as the cinema chain saw over 39m people come through its doors.

Reserve Bank of Australia interest rate decision

GIL reported a PAT of INR 807mn, which was below our estimate of INR 1237mn driven by weak operational performance. The BP share price has outperformed the market ahead of the company’s Q2 results announcement on 2 August. Boosting investor sentiment is soaring global energy prices and the fact that its rival oil majors posted record earnings last week. Sequent Scientific has posted revenue of INR 3,506mn with a 1.2% YoY increase, which was 13% above our estimate of INR 3,102mn. The revenue beat was mainly driven by higher than expected growth in formulation business; However, API business de-grew by 10.4% due to lower offtake of Albendazole . The formulation business grew by 6.1% , led by strong performance in LATAM (+34.5% YoY) and Europe (+10.3%).

- Meanwhile, oil and gas prices have rocketed, partly because of uncertainty about supplies from Russia amid its invasion of Ukraine, contributing to a cost-of-living crisis.

- BP’s statement and a subsequent earnings call last week did not yield further clarity on the reasons for the reduced fair value estimate of the Indian assets and liabilities acquired from RIL.

- The company said it will increase its focus on low-carbon bioenergy and also set a target to produce 0.5 million-0.7 million tonnes a year of low or zero-carbon hydrogen to initially supply its own refineries.

- Revenue from admissions accounted for $443.8m of total revenue as the cinema chain saw over 39m people come through its doors.

- Policymakers have raised rates at each of their last five meetings and a further increase in the cost of borrowing appears nailed on.

Back in mid-June, BP announced a 40.5% investment in an Australian solar, wind and hydrogen project called the Asian Renewable Energy Hub . The company is shifting towards renewable energy production and plans to cut emissions to net zero by 2050. BP plans to go on a major spending spree and build or acquire 50GW in renewable power generators by 2030 — a long way off the 1.9GW it had at the end of 2021. The results were impacted by weaker gas trading activity after an “exceptional” third quarter, higher refinery maintenance and lower oil and gas prices. Salt said BP expected further reforms in gas prices in India to unlock the potential for development of gas producing assets and there was already evidence of such reforms being possible through discussions with the government. Under the deal struck between the two companies, up to $1.8 billion of the total investment made by BP in RIL’s assets will be payable on future exploration success in those oil and gas blocks.

NWIL and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. NWIL also acts in the capacity of distributor for Products such as PMS, OFS, Mutual Funds, IPOs and/or NCD etc. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. Keir Starmer, leader of the opposition Labour party, said BP’s profits show that a windfall tax is a right approach.

Big Oil set to open cash taps with another record quarter – Reuters

Big Oil set to open cash taps with another record quarter.

Posted: Thu, 21 Jul 2022 07:00:00 GMT [source]

However, there is no doubt that a shift towards renewable energy will help BP safeguard its position as a key energy player well into the future. BP saw an exceptionally strong underlying profit in Q1 as energy prices began to soar. The group’s underlying replacement cost profit rose to $6.2bn in the first three months of the year which was considerably higher than the $2.63bn seen in Q1 2021.

All eyes will be on the Bank of England on Thursday when it meets to discuss its latest response to soaring inflation. Policymakers have raised rates at each of their last five meetings and a further increase in the cost of borrowing appears nailed on. They may opt for another cautious quarter-point rise, but there is a chance we’ll see the first half-point rate hike in the Bank’s 25 years of monetary policy independence. Meanwhile, Friday’s US jobs report for July could add to fears that the country’s labour market is weakening. BP plunged into a net loss of $16.8 billion in the second quarter, the British oil giant announced Tuesday, as the coronavirus pandemic ravaged demand for oil, sending prices tumbling. About whether the government should tax energy companies that make unexpectedly big profits to help people struggling to get by.

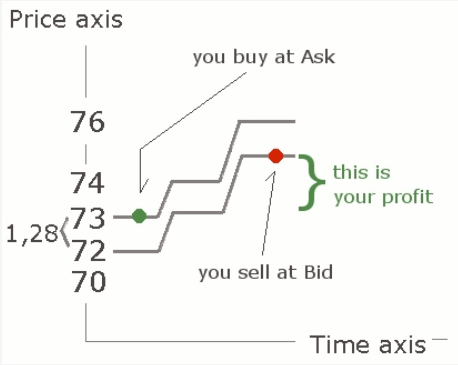

Shell reported record adjusted earnings of $11.5bn alongside announcing a $6bn share buyback scheme, while ExxonMobil and Chevron saw earnings of $17.9bn and $11.6bn respectively. It is expected that BP will continue this strong trend in its earnings report. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Meanwhile, oil and gas prices have rocketed, partly because of uncertainty about supplies from Russia amid its invasion of Ukraine, contributing to a cost-of-living crisis. The penetration of the mutual fund industry in India is close to 7% . This under penetration of the mutual fund industry offers a huge opportunity for the industry to grow. BP’s December quarter earnings statement last week said the $785 million adjustment and a few others “reflected new information obtained, including further understanding of the acquired assets and potential development options.”

Putting the write-down to one side, the how do i transfer my shares performed well as underlying profits rose to $6.25bn, up from $2.63bn a year ago. Oil and gas production and operations accounted for $4.68bn of the total, beating expectations for $4.5bn. The company’s earnings report comes as BP aims to cement itself as a key player in the global clean energy shift.

Unemployment was steady at 3.6%, while wage growth also remained stable at 5.1% compared to the upwardly revised May figure of 5.3%. However, the labour force participation rate unexpectedly dipped to 62.2%. With job vacancies at record levels, participation ought to be increasing. The company said it will increase its focus on low-carbon bioenergy and also set a target to produce 0.5 million-0.7 million tonnes a year of low or zero-carbon hydrogen to initially supply its own refineries. Honest taxpayers need to be commended while those abusing the system should face action, finance minister Nirmala Sitharaman said at The Economic Times Awards for Corporate Excellence 2022 checkout https://www.cash-buyers.net/north-carolina/cash-buyers-for-houses-jacksonville-nc/